2024 New York Itemized Deduction Webpage Form – You can claim itemized deductions on your New York tax return regardless of whether you do so for federal purposes. New York allows deductions for such expenses as: You can claim New York’s . The standard deduction reduces the amount of your taxable income—the IRS has increased it in 2023 and 2024, which could result in a lower tax bill for many Americans. .

2024 New York Itemized Deduction Webpage Form

Source : www.nslawservices.orgW 4: Guide to the 2024 Tax Withholding Form NerdWallet

Source : www.nerdwallet.comComments on New York City’s Executive Budget for Fiscal Year 2024

Source : comptroller.nyc.govWhat is the IRS standard deduction for taxes 2023? al.com

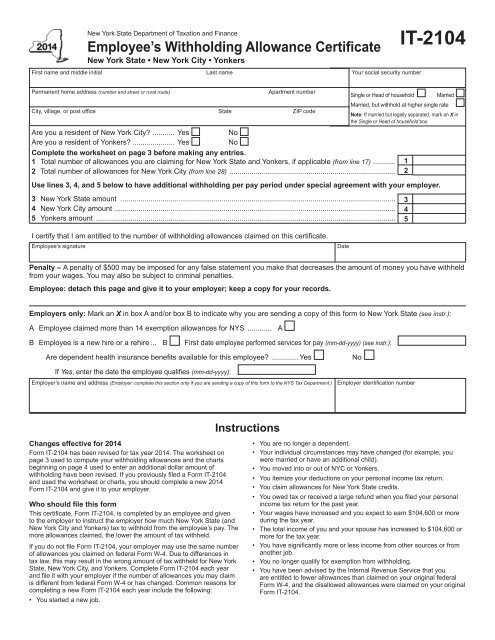

Source : www.al.comForm IT 2104 New York State Tax Withholding South Colonie

Source : www.yumpu.comReport to the Mayor and City Council on City Comptroller Audit

Source : comptroller.nyc.govI.R.S. to Begin Trial of Its Own Free Tax Filing System The New

Source : www.nytimes.comAnnual Summary Contracts Report for the City of New York : Office

Source : comptroller.nyc.govForm IT 272 Claim for College Tuition Credit or Itemized Deduction

Source : www.dochub.comNew York Sportsbooks: Betting Sites, Apps & NY State Guide

Source : www.si.com2024 New York Itemized Deduction Webpage Form Free Tax Clinic Bethpage VITA at Touro Law University – Nassau : To claim your itemized deductions, fill out Schedule A of the Form 1040. Each line on the schedule describes a specific type of allowable expense that can be itemized. How to calculate itemized . Stay updated on the standard deduction amounts for 2024, how it works and when to claim it. Aimed at individual filers and tax preparers. .

]]>